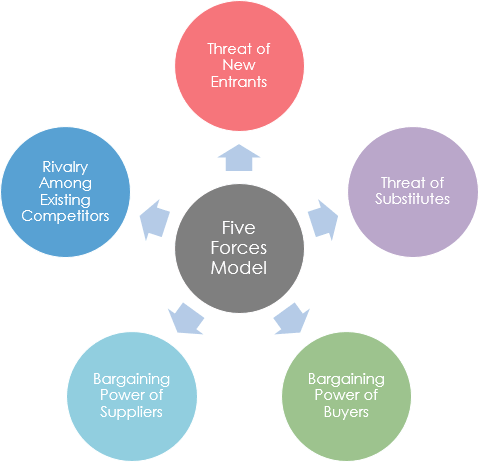

Porter’s Five Forces model is a framework developed by Michael Porter to analyze the competitive environment of an industry.

Let’s break down porter’s five forces model with examples of the automobile and e-commerce industries:

1 Threat of New Entrants: This force examines how easy or difficult it is for new companies to enter the industry. High barriers to entry, like high capital requirements or strong brand loyalty, can reduce the threat of new entrants.

In the automobile industry, significant barriers such as high capital requirements, established brand identities, and complex supply chains make it difficult for new entrants to compete.

In e-commerce, while it’s easier to set up an online store, established giants like Amazon have already captured a significant share, making it challenging for new players to gain traction.

2 Bargaining Power of Suppliers: This force assesses how much control suppliers have over the industry’s businesses. Suppliers might have more bargaining power if they have few alternatives or can easily switch to other industries.

In the automobile industry, manufacturers depend on suppliers for various components. If few suppliers dominate the market, they can exert higher prices or control production, affecting the automakers’ profitability.

In e-commerce, suppliers might include manufacturers of products sold online, and platforms with diverse suppliers could wield more bargaining power.

3 Bargaining Power of Buyers (Customers): This force evaluates how much control customers have over the businesses. When customers have many options or can switch easily, their bargaining power increases

In the automobile industry, customers’ bargaining power is often moderate, as they can choose from various brands, but switching costs and the emotional value of a vehicle can still influence their decisions.

In e-commerce, customers have more information and options, giving them higher bargaining power and making it easier to compare prices and switch between platforms.

4 Threat of Substitutes: This force considers the availability of alternative products or services that could fulfill the same need as the industry’s offerings. The higher the threat of substitutes, the more challenging it is for companies in the industry to maintain their prices and market share.

In the automobile industry, public transportation, biking, or car-sharing services are substitutes that could impact demand.

In e-commerce, traditional brick-and-mortar stores are substitutes, and technological advancements could introduce new ways of shopping, affecting online retailers.

5 Competitive Rivalry: This force looks at the level of competition among existing firms in the industry. Factors like the number of competitors, industry growth rate, and differentiation of products can influence the intensity of rivalry.

The automobile industry is highly competitive due to the number of manufacturers competing for market share, leading to aggressive marketing and innovation.

Similarly, e-commerce experiences fierce rivalry as numerous online platforms compete for customers by offering convenience, pricing, and unique services.

In the automobile and e-commerce industries, Porter’s Five Forces model helps identify the key factors influencing the industry’s profitability and competitiveness.

Let’s learn Porter’s Five Forces Model with Examples

1. Smartphone Industry:

– Threat of New Entrants: The smartphone industry has high barriers to entry due to the need for substantial capital investment, complex technology, and established brand loyalty.

– Bargaining Power of Suppliers: Suppliers of key components like processors and display panels have relatively high bargaining power, as there are limited suppliers and switching costs can be significant.

– Bargaining Power of Buyers: Buyers have considerable bargaining power due to the availability of many brands and models, leading to intense competition and price sensitivity.

– Threat of Substitutes: Substitutes like basic phones or other communication devices pose a moderate threat, especially in emerging markets where affordability is a concern.

– Competitive Rivalry: Intense competition among established players like Apple, Samsung, and Huawei results in rapid innovation, aggressive marketing, and frequent product releases.

2. Airline Industry:

– Threat of New Entrants: The airline industry has significant barriers such as high capital requirements, strict regulations, and limited airport slots, making it difficult for new players to enter.

– Bargaining Power of Suppliers: Aircraft manufacturers hold substantial power, as airlines depend on their products and switching costs are high. Fuel suppliers also have some bargaining power due to limited alternatives.

– Bargaining Power of Buyers: Buyers, which are travelers, have moderate power due to their sensitivity to prices and the availability of various airlines and routes.

– Threat of Substitutes: Substitutes like trains, buses, and video conferencing pose a moderate threat, especially for short-haul flights and business travel.

– Competitive Rivalry: Intense competition among airlines leads to price wars, service differentiations, and the constant need to manage costs.

3 Fast Food Industry:

– Threat of New Entrants: The fast food industry has moderate barriers to entry due to the need for branding, location, and efficient supply chain management.

– Bargaining Power of Suppliers: Major fast food chains have significant bargaining power over suppliers due to their scale and ability to dictate terms.

– Bargaining Power of Buyers: Buyers in this industry have moderate power, as they can easily switch between brands based on price, taste, and convenience.

– Threat of Substitutes: Substitutes like home-cooked meals, healthier alternatives, and casual dining options pose a moderate threat.

– Competitive Rivalry: Intense competition among fast food chains results in continuous menu innovation, aggressive marketing campaigns, and attempts to differentiate through pricing and taste.

Porter’s five forces model with examples of the above three industry illustrate how the five forces interact in different industries to shape competitive dynamics and strategies.

Follow Nitin Kr Saxena

Professor of Marketing & an esteemed alumnus of IIM Ahmedabad, Dr. Saxena holds a Ph.D. in Brand Management, which garnered him the prestigious Best Ph.D. Thesis award. Recognized for his exceptional contributions to academia, Dr. Saxena has been honored with the Young Faculty by CEGR. Additionally, he received the “Best Professor in Marketing Analytics” award.